The traditional world of financial services is being disrupted by agile fintech start-ups and big hitters like Bitcoin, Revolut and Paypal. The pace of innovation is suddenly breath-taking, leaving the incumbents trailing. How should they respond?

New entrants can bring substantial investment and appeal to savvy digital native early adopters but most importantly they bring clean sheet thinking. While incumbents are entangled in legacy IT systems and labyrinthine internal processes new entrants can apply a new breed of digital-first agile technology, innovative product solutions and a customer centric approach.

In addition, building a brand from scratch is hugely difficult in the big-budget competitive world of financial services, so disrupters are prepared to break the mould with imaginative and creative communications. They are succeeding, as a study by Kantar shows, the brand value of the traditional high street banks has dropped by a collective $2bn over the last year due to the impact of challenger brands. Over-reliance on name and history is costing already.

How are Fintech disruptors changing the financial services industry?

Here are the top 4 takeaways we have learned from Fintech and big hitters disruptors:

1. Customer-first thinking

Challengers utilise their data assets to add customer value with timely, focused and meaningful interactions so that the customer feels in control. Demonstrating a genuine interest in customers ensures they are close to the aspirations, emotions and behaviours to connect and engage even when this is facilitated digitally rather than through branches and call centres.

Customers are faced with genuine choice and are starting to explore their options. Finding that disrupters have excellent UX, talk their language and solve genuine needs leads to engagement and advocacy, spreading the word via social media and accelerating growth through network effects.

The key takeaways are:

- Customer Centricity: establish a customer-first culture from the outset supported by simple user interfaces and responsive CRM to bring the value proposition to life for the customer.

- Build in marketing automation financial services tools to provide customer nudges and guidance on a micro-segment level.

- Utilise social selling to jump-start awareness and trial. Account-based selling can be amplified using social media and advocacy.

Traditional financial services organisations need to respond urgently because like all fundamental transformations, once momentum has built, the world will be changed forever. It’s time to get smart.

An example of smart customer thinking is the AvivaPlus TV commercial, which promises the same or better pricing for existing customers. It’s smart because customer lifetime value is what drives profit. Acquisition cost is sunk in the first year but a happy customer keeps on giving year after year through continued purchases, reduced service costs and referrals. Making this claim on TV is bold and meaningful, cutting through the clutter and demonstrating Aviva’s commitment to customers.

2. Use personalization for marketing

Our approach to tackling the challenge is to get close to customers and think hard and smart about where imaginative opportunity lies. The answer will surely lie in utilising the vast data assets to personalise value adding solutions to bespoke to individuals which may seem unimaginable but is exactly where disrupters are heading.

For incumbents much can be accomplished by smart thinking around underlying customer needs and building in product flexibility in an original and relevant way. Just as when you buy a new car there is the opportunity to personalize through options and extras, flexible choices can be built into financial services. To unlock the cookie jar you need to get close to your customers to understand, at a deeper level, what they really value and give them those choices. This is the difference between inside-out thinking where the business is designing the customer offer to suit the business, and outside-in thinking where the customer can personalize their choices to add practical and emotional value as seen through their own eyes.

In the same way, digital marketing can now be automated to provide individual, timely, messages to customers as they interact to nudge action and prompt responses. This intelligent personalised communication adds a new dimension to on-line interaction and substantially increases conversion and revenue.

A deep-dive workshop can help discover how to connect with your target customer the way disruptors do. Find out more about planning a workshop.

3. Digital Only: Upset traditional models

For incumbents an astonishing part of the disruptor revolution is the success of digital-only models where the traditional bank branch or broker has been entirely replaced by on-line tools and apps. This completely changes the cost structure of the provider enabling rapid scaling and keener pricing.

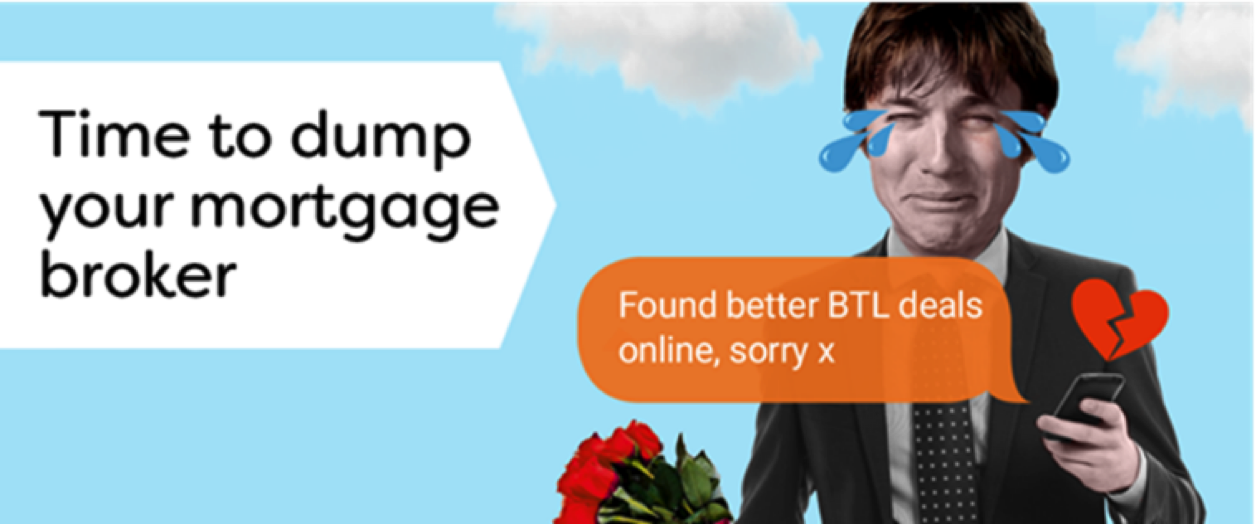

Start-up Property-Master has a disruptive business model that adds customer value by cutting out the mortgage middleman. Instead of lengthy form filling and an uncomfortable visit from a shiny-suited broker the user enters details online which are matched with lending criteria. The result is a completely digital personalised ranking of the best mortgages available in minutes not days and a lively brand that connects with real people at a human level.

4. Focus on your market

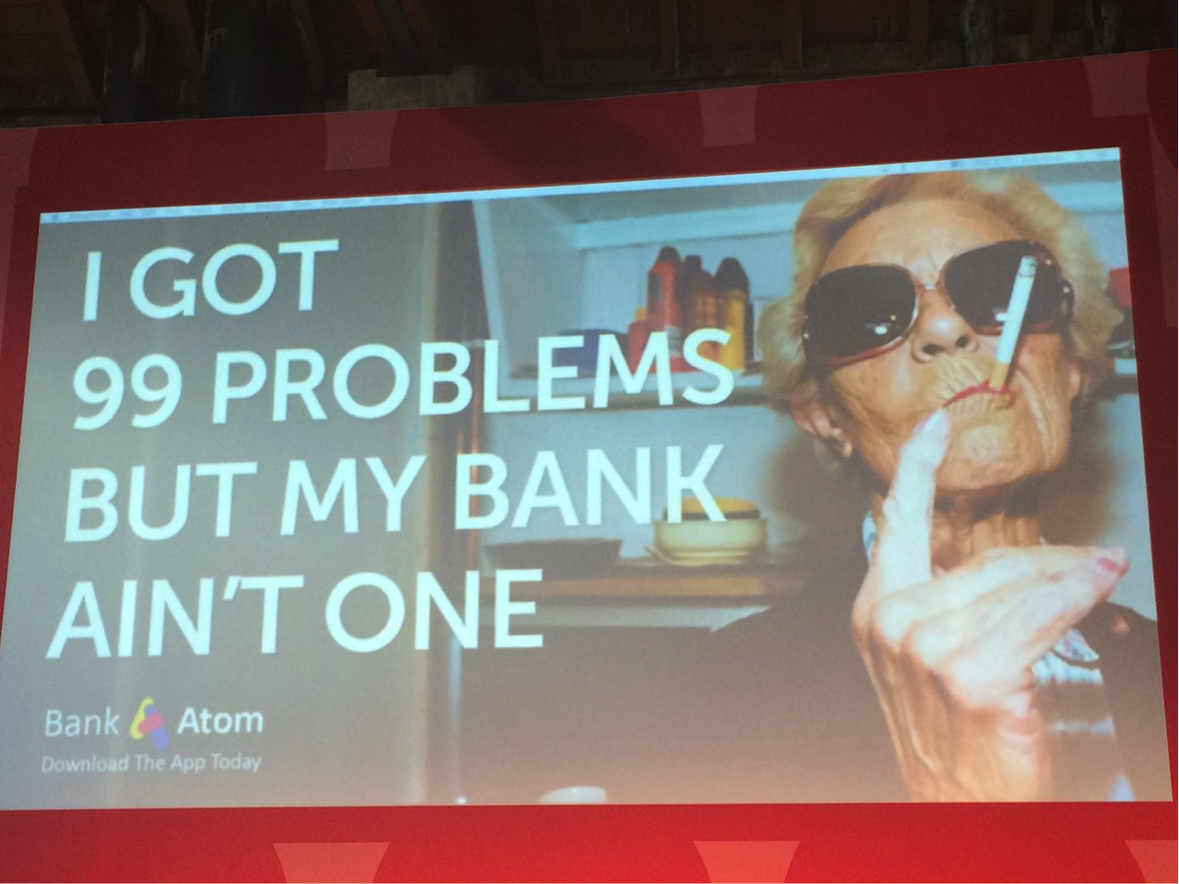

Monzo the phenomenally successful payment card, and Atom the “bank in your pocket” are both examples of deep customer thinking that radically re-sets the status quo. Atom said “We’re not for a target demographic. We’re for an audience united by a mindset and a set of behaviours”. They recognise that customers want brands that resonate and help improve their everyday life. Customers wake up wanting a holiday, or a house or a car or a lie in – and that feeling is both about practical help and emotional empathy. Atom concentrated their media, broke the old bank roles, collaborating with trailblazing media brands and created sharable communications in the customer’s language.

Financial services takes the next step

Fintech disruptors have the advantage of clean-sheet thinking and technology that powerfully enable them to leverage customer-first thinking, personalization, digital-only models and clear market focus.

However, traditional players can respond effectively by translating deep customer insight into original strategies, harnessing powerful customer aspirations and emotions to create and deliver engaging stand-out financial services communications.

Taking a different approach helps traditional financial services clients challenge disruptors and helps disruptors disrupt.

Read more about financial services marketing in the age of disruption.

Get help

Got a Financial Services problem that is keeping you up at night?

Get in touch with our dedicated UK team here.